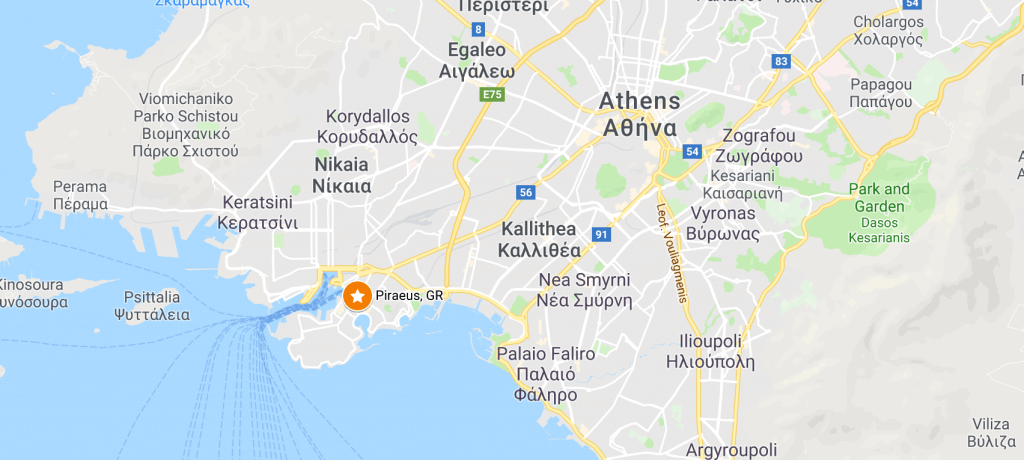

Piraeus Partner Profile

On the coast, south of Athens, Piraeus has an important position geographically and is home to a major EU freight port.

About the city

- Piraeus has a population of 165,000 and is part of the wider Athens urban area.

- The unemployment rate is 16% and the employment rate – at 53% – is well below the EU2020 target of 75%. 34% of the population is defined as being economically inactive and the city has a rapidly growing ageing population.

- 98% of all companies are small and medium sized enterprises (SMEs) with the remaining 2% (companies of over 250 employees) employing 28% of the workforce.

- Key local employment sectors include wholesale and retail and transport/logistics and public administration. Manufacturing accounts for just 10% of employment.

- Blue growth, linked to marine tech, is seen as an important emerging sector.

- The clustering of strong transport infrastructure coupled with the concentration of knowledge-based economic sectors are seen as major economic drivers.

About the policy context

The good practice will be transferred within the following policy contexts:

- At national level TechRevolution is well aligned with the 2014-2020 ESIF Partnership Agreement which includes priorities to enhance business competitiveness by moving towards entrepreneurship and innovation to grow higher value jobs.

- The regional Operational Programme and Smart Specialisation Strategy also advocate more innovation in order to support higher value job creation.

- At local level the project fits with Piraeus Municipality’s strategic planning for the ESIF programming period 2014-2020, which includes priorities around enhanced business activities, investment, competitiveness and entrepreneurship. It also links with the 2018-2024 Blue Growth Strategy which is predominantly funded through the €80m Integrated Territorial Investment (ITI) programme.

Strengths and Weaknesses

Strengths

- Strong and distinct identity of the population, intrinsically linked to the sea and its occupations

- International and active shipping centre and gateway to international trade and commerce

- Port infrastructures capable of serving ships of any type (cruise ships, passenger ships, yacht)

- Dynamic growth as one of EU’s most important & fastest growing ports of Europe

- Strong presence of complementary processing activities, wholesale& distribution / logistics

- Interconnection with all forms of transportation (metro, railroad, highway, airport)

- Direct proximity of port activities and infrastructures to the urban fabric

- Reasonably specialised knowledge base interms of Blue Economy

- Critical mass of educational and research institutions

- Promotion of the Blue Economy as one of the three areas of expertise of Attica RIS3& various initiatives aimed at supporting a Blue Economy

- A strong drive & commitment to collaborate with other cities with similar characteristics internationally

Weaknesses

- Poor demographic and social indicators (high population density, high rate of aging, low percentage of economically active population, high rate of long-term unemployed/young unemployed/unemployed women)

- Insufficient development of tourist activities, services and infrastructure, proportionate to Piraeus size and potential

- Shrinking number of enterprises and employees in all sectors

- Relocation of strong and recognisable shipping companies from Piraeus to other areas of Attica

- Gaps in the urban fabric resulting from deindustrialisation

- Traffic and environmental pressures

- Lack of collaborative business culture among entrepreneurs

- Lack of coordination among local actors for the promotion of Blue Growth in Piraeus and the wider region

- Lag in the Research, Technological Development and Innovation indicators and low level of spending compared to other advanced regions of the EU

- Limited interface between the research and business community

Opportunities and Threats

Opportunities

- Sustained interest of companies – investors in the city’s cruise industry

- Significant room for tourist flows, with multiple benefits for local development and employment

- Completion of the investment program of the Piraeus Port Authority and enhancement of the role of the port

- Recognition, by stakeholders, of the importance of the Blue Economy activities for the wider region

- Financial opportunities from NSRF, Integrated Spatial Investment funding tool and the European funding programs for the implementation of projects and the support of entrepreneurship and innovation

- Promotion of Blue Growth by the EU as a policy that will contribute to smart, sustainable & integrated development.

- An increased interest by DG MARE for the investment needs and potential tools for funding Blue Growth projects

- Increasing EU funding available for ICT, Research, Technology and Innovation

Threats

- Deterioration of the already burdened economic and social conditions and widening of the social divides.

- Expansion of traffic flows passing through Piraeus

- Shrinking of the processing and manufacturing sectors and relocation of many productive units outside the country

- Competition from other countries (e.g. Cyprus, Singapore) to attract shipping &investments in the Blue Economy

- Insufficient public resources, reduced liquidity in the private sector, limited funding from the bank system and slow progress rates of the relative programs

- Investment uncertainty (economic conditions, bureaucratic interference, tax regime)

- A complex field of actors with different and often conflicting views and a lack of mature “culture” of cooperation

- Brain drain

- Strong competition inside and outside the EU in Research, Technological Development and Innovation

A description of the Good Practice challenge in the city

The city wants to transform its economy from one, which historically was reliant on traditional sectors to one with a range of high quality jobs for all citizens, and closely linked to Blue Growth. To this end, since 2014 it has been delivering the Blue Growth Initiative, which supports the development of start-ups, incubates new companies, facilitates and accelerates knowledge transfer and offers mentoring support and a platform for collaboration in the blue growth sector.

To date 20 start-ups have been developed, creating 45 jobs. This has been recognised as an URBACT good practice and Piraeus is leading a transfer network within this theme called BLUACT.

Piraeus & TechRevolution

Piraeus wants to build on this and will use TechRevolution to…

Learn from others and inform the delivery of the Blue Growth Digital Innovation Hub (BG-DIH) which has a planned opening date of early 2019, (supported with €1.8m funding from the Attica Regional Authority)

- Enhance the community offer, facilities, specialist equipment and services to be provided within the Hub e.g. community events and networking; start-up support; commercialisation of products and services and engagement of young people in use of advanced technological equipment

- Feed into future efforts to help local companies foster their competitiveness by improving their business/production processes as well as products and services through use of digital technology

- Develop ways to mitigate barriers associated with investment in new technology that often prevent entrepreneurs from exploring new opportunities due to high costs and lack of adequate entrepreneurship support

- Better understand how to develop the necessary physical and virtual infrastructure to attract and grow high skilled, high multiplier digital businesses

The URBACT Local Group (ULG)

The ULG will spin out of the pre-existing Maritime Hellas Cluster, the ITI Project Management Team and the BlueGrowth Initiative Marinescape. Its objectives include:

- Actively participating in transnational learning and exchange

- Using this learning to support capacity building of key decision makers, enabling them to make evidence-based policy decisions

- Framing transfer problems and agreeing transfer priorities and concrete solutions in order to address these problems

ULG membership will include main actors of the BGI MarineScape. Indicatively such stakeholders will be: Municipality of Piraeus (Executive City Councilor’s Office for Local Economic Growth and Entrepreneurship , Piraeus’ ITI Intermediate Body), University of Piraeus, Piraeus University of Applied Science, Hellenic Centre for Marine Research (HCMR), Centre for Research and Technology-Hellas (CERTH), Piraeus Chamber of Commerce and Industry, Chamber of Small and Medium Sized Industries of Piraeus, Hellenic Chamber of Shipping, Aephoria.Net (incubator cooperating with the municipality on the BGI competition) and STRATEGIS-Maritime ICT cluster.

Assets for, and barriers to, transfer

The city has significant experience in the Blue Growth field and an increasingly recognised blue economy cluster. There is a vibrant entrepreneurial culture, an ambition to do something big and meaningful in this space, an existing community committed to delivery and a clear understanding of the various essential components of a tech entrepreneurship ecosystem. In addition the municipality now has 4 years’ experience delivering the Blue Growth Initiative (funded through private sector sponsorship) and has secured resources along with strong political commitment to deliver a blue growth digital innovation hub. The hub sits alongside 14 other actions framed within an Integrated Territorial Investment programme which, together, devote a significant €25.4m to entrepreneurship and business innovation.

However there are a number of perceived challenges, which include:

- Public procurement rules dictate that the Municipality has to procure an external provider to develop the hub (facilities and community) for the first 28 months. It will be challenging to find a suitable provider who can be agile and innovative in delivery in this context.

- Municipality staff has been cut from about 1800 to about 1300 over the last 8 years. This can make day-to-day operations a little cumbersome and means the municipality has to work hard to function more entrepreneurially which will be a key success factor of the transfer.

- The transfer will need to take into account the clear differences in geographical, demographic, economic and social contexts e.g. Piraeus still considers itself to be in the middle of an economic and financial crisis

- Working relationships between the public and private sectors are still relatively new. In an ideal world, entrepreneurs would probably be in the driving seat. It may be difficult to instil an entrepreneurial approach within a public institutional context. It will be important to be creative about future governance structures so that hub management can be entrepreneurial, take informed risks and act quickly where necessary.

Practical steps to transfer the GP

Piraeus is interested in using the following techniques to transfer the good practice:

- Deep dive into the Barnsley good practice to really unpick success and failure factors

- Ongoing support and advice from Barnsley to the project team throughout the delivery of the hub – a sort of safety net during a potentially challenging process

- Development of a shared understanding of the good practice – and a shared value base – between local stakeholders – and a genuinely collective transfer effort with room for everyone to contribute in a meaningful way.